Everybody says you should buy a house. Paying rent is just throwing your money away. Whenever everybody says something, that should be a signal to really think it through. Buying a house is the biggest financial decision most people will ever make.

A house is where you live, it is not an investment. Forbes says the era of home appreciation is over.

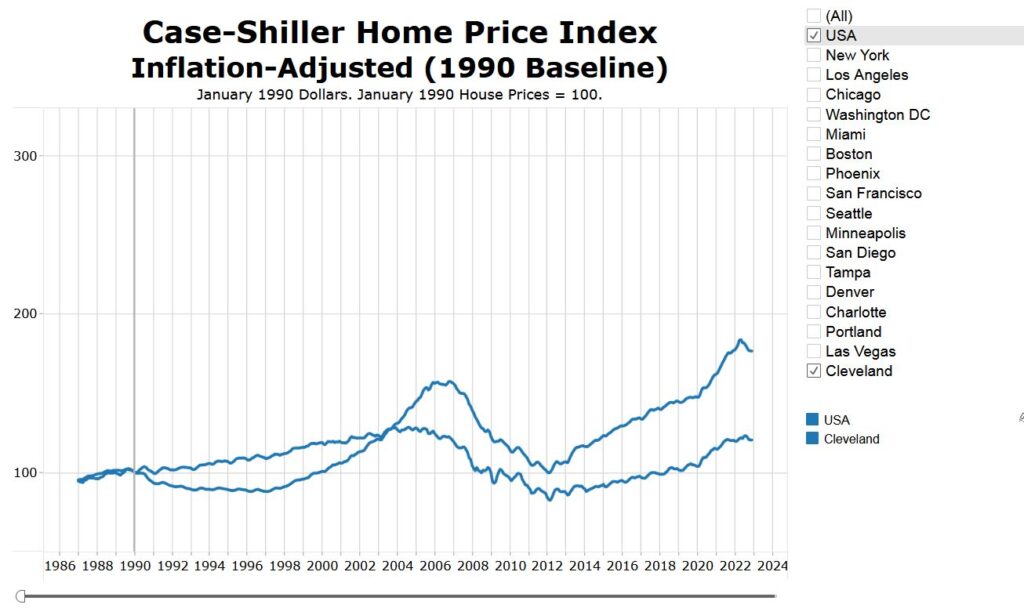

This gives inflation-adjusted home price. The lower line is Cleveland, the upper line is nationally.

This is the Dow Jones Industrial Average in inflation-adjusted numbers for a longer time frame.

First Tip: Never borrow money to invest. If you only invest money you have, you can lose it. If you borrow money to invest, you can be ruined. That applies to mortgages and buying stocks on margin.

Second Tip: Invest for the long term. The Forbes article suggests that the recent appreciation in home prices resulted from Fed policies that loosened credit and kept the interest rates low. There are always unforeseeable external factors that alter the value of an investment. Over the long term, disturbances balance out.

Third Tip: Real estate as an investment is not the same as buying the house in which you live.

A house is not a liquid investment. It generally takes three months for a house to go from listing to closing. If you need money fast, a home equity loan is a possibility. Assume that 10% of the value of the house will be lost in selling. Time and money goes toward preparing the house, fees and commissions.

Fourth Tip: An index mutual fund is the best choice for the uninformed investor. The stock market is currently in the tank, yet my Fidelity Contrafund has risen an average of 10.4% every year for the last ten years. I’m not saying that’s the best big fund, so do your own research.

Buying a house is not an investment, but people have to live somewhere. Paying rent does not build equity, but there are some advantages. Since the renter doesn’t own the property, the renter isn’t responsible for anything. With the exception of a security deposit, the renter has little risk of losing any money beyond what is paid for rent and utilities. Moving somewhere else is much easier.

Fifth Tip: Image the perfect lifestyle for you. Think through the actual ramifications of what seems like the perfect domestic arrangement.

I’d love to live in a cave or a mountain hermit shack or an abandoned bunker. However, none of those are available in my area. Internet and utilities would be an issue, and parking would be a consideration. There are probably other drawbacks.

Someone who loved dorm life, may enjoy having few domestic chores and have little interest in personalizing the accommodations. Renting could be the solution. There is little financial risk and costs are fixed. A nicer complex may plan social events.

Someone who doesn’t need much, but wants the space to perfectly reflect their personality and lifestyle, might consider a condominium or cluster home. A condo is more like an apartment, so generally has less space and the risk of noisy neighbors. A cluster home is more like a house. The rules vary, but usually, the owner is only responsible for the inside. It’s been said that these don’t hold there value like a house, but that makes buying one more affordable. A monthly maintenance fee is probably a couple of hundred bucks, but that is cheaper than a house.

Sixth Tip: Owning a house is not cheaper than renting. The owner is responsible for all maintenance and repair. That means acquiring the skills and tools for the job or paying a premium for someone with the skills and tools to do the job. My property tax is $350 per month.

A suburban house in a development requires a lawn mower, weed wacker, wheelbarrow, snow shovel, lawn cart, shovels, buckets, garden hose, a couple of rakes, paint brushes, rollers, a few ladders, screwdrivers, power drill and a leaf blower. The owner buys, maintains and uses those. There may be a Home Owners Association (HOA) that restricts exterior choices and levies a monthly maintenance fee of a couple of hundred bucks per month.

To get a house with some land for recreation and privacy, the owner may need a cargo trailer, tractor or quad, chainsaw, log splitter, power washer, air compressor, hedge trimmer, yard trailer, tank sprayer, backpack blower, sledge hammer and farm jack.

Seventh Tip: Don’t buy anything just because someone said you should. If it’s a mistake, it’s still your problem. Rent until you know who you are and what you will want for the next five years or so. Be disciplined enough to take the extra money and sock it away in an index fund.

Eighth Tip: Everything is a trade-off.